Essential Tips for Mastering Insurance Policy Shopping

In the past five years, Texas has experienced a rise in storms and litigation from automobile accidents. Additionally, the cost of auto parts, building materials, and labor have all increased. Because of this, the cost of insurance claims has increased, causing higher premiums and stricter policies.

Michael Alexander from Energy Capital Insurance shares FIVE things to remember when policy shopping!

Insider Tips for Choosing Insurance Policies

The Value of Detailed Information

The more information you can give to your agent about who lives in your household that can operate a vehicle will result in the most accurate, and often most competitive, premium quote. Quoting software is designed to assess risks and details average consumers may not think about. That could result in the difference of hundreds of dollars in auto insurance premiums.

"Fifteen minutes or less" entering information on a website might be convenient but it is no substitute for an honest conversation with an experienced agent. Your pocketbook will know the difference.

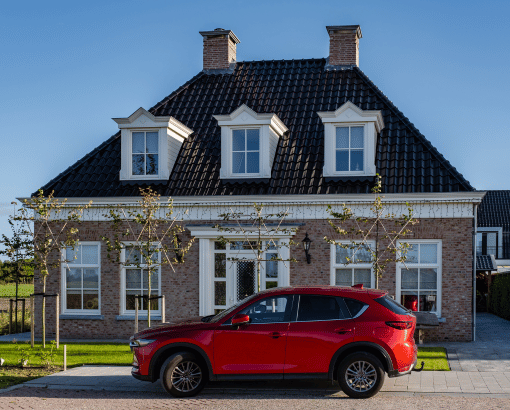

Texas Home Insurance Challenges

Consumers in Waller County, Harris County, Liberty County, and places south of there, do not be offended if your insurance agent declines to offer you a homeowners policy quote. Many carriers are ceasing to write new home insurance policies in Texas (your agent will know if your home qualifies for a new policy based on characteristics).

Agents are very familiar with the carriers' underwriting guidelines, especially those who they hold contracts with. Carriers currently prefer to accept new business on homes less than 10 years old with the roof age of five years or less. It may be better to work with your agent to identify possible savings within your current policy rather than seeking a new policy with another carrier.

Understanding Full-Coverage in Insurance

The most misused and dangerous term in the industry is full coverage. Remember, what you consider full coverage may mean something totally different from what your agent thinks. Take the time to review the available coverages on your policy and identify the level of each one that fits your needs and budget.

A conversation about coverage with your agent can save you from paying for coverage you may not need, and more importantly, prevent you from paying out of pocket damages you thought were covered but were not.

Home Inspections for New Policies

When you purchase a new homeowner's policy, be prepared to undergo an inspection within the first 30 days of the policy. While this has always been standard practice, the home inspection has become an important tool for underwriters seeking to verify your home is a good risk.

An inspector contracted by the insurance carrier will thoroughly review and document with photos the condition of the roof, home exterior, and outbuildings. Some carriers will also now require an interior inspection to verify that there is no unrepaired damage and to confirm the level of finishes used to calculate the replacement cost of your home. An underwriter reviews the inspection report and communicates to the homeowner any concerns or needed repairs they would like resolved in order to continue the insurance coverage on the home. If these concerns are not resolved within the time period allowed by the carrier, the homeowner’s policy can be terminated.

Be sure to discuss with your agent the types of conditions an inspector may look for when purchasing a new homeowner’s insurance policy.

The Truth of Bundling

Remember that in today's insurance market, bundling your home and auto policy with the same carrier may not result in the discounts and savings that it has in previous years. In some cases, it may not be possible.

If you are a dedicated bundler, you may be doing yourself a disservice. Be willing to explore the options your agent provides.

ECCU offers full-service insurance options for home, auto, commercial, and MORE! Energy Capital Insurance can find personalized quotes with the best coverage options to meet your needs!

Have questions about your current insurance policies?

Contact us at Insurance@eccu.net or call us at 832-604-2160

Michael Alexander, Energy Capital Insurance Agent

<img

<img